'My CAR is my First & Foremost LOVE. Nothing else matters as much as my CAR'. If that's you, then #COCODrive is the right car insurance for you.

'A car is a car is a car, which carries me from place A to place B'. If that's you, then #COCODrive is going to change your outlook.

![]()

'My Car is my confidante, whenever I am sharing my signature lifestyle with Family & Friends'. If that's your Life-Line then #COCODrive is yours forever. DHFL General Insurance believes in #CareMoreHaveMore

![]()

Now the million Dollar (rather Diesel/Petrol) question is, What's #COCODrive all about?

To give you a background about the brand that has launched COCODrive . COCO by DHFLInsurance is a leading InsureTech (General Insurance venture) in India. It is the flag bearer for innovation in products, distribution and customer experience in the Property & Casualty Insurance domain in India. It strives to simplify the tedious and confusing process of purchasing insurance through new age technology.

COCODrive is India's first fully customizable, online, comprehensive car insurance policy which offers 19 add-ons to choose from to suit each customer's specific needs. The pick and pay customizable policy provides suggestions to customers to help them pick the right add-ons.

![]()

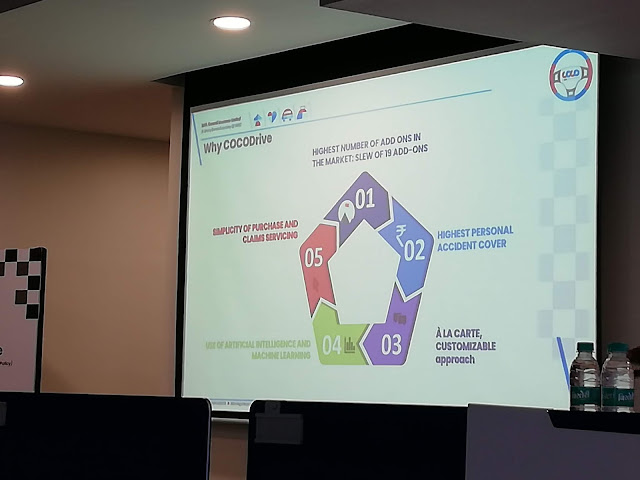

Why COCODrive? Let's check out the 5 benefits and fantastic features of #CoCoDrive

1• Highest number i.e. 19 Add-Ons: Most insurers offer maximum 5 to 6 add-ons. COCO believes that the consumer should opt for the coverage they may require, depending on the type, age of car, and city of residence.

2• Country’s first à la carte motor policy: Consumers have a wide choice of add-on covers, rather than having to buy a bundled product, with features they may not need.

3• Highest Personal Accident cover: COCODrive offers owner, occupant and paid driver personal accident cover that can go up to 35 Lakhs. The current mandate offers a personal accident cover of 15 lakhs.

4• Truly customizable with simplicity of Purchase and Claim servicing

procedure. With a chat feature, consumers can have a guided ecommerce buying experience.

5• Use of Artificial Intelligence and Machine Learning.

![]()

Consider these add-ons while taking Car-Insurance cover:

Zero Depreciation: We should buy this cover as depreciation on parts is as high as 50%.

New Car for Old Car: Pay less than 0.50 paise a day, and get a claim worth new vehicle value, in the event of theft or total loss.

Consumable Expenses: Deduction of cost of consumables like screws, engine oil, nuts, bolts, fuel filter, lubricants, brake oil, and grease etc. is frustrating. Consumable Expenses cover will manage this.

Engine Protector: If we live in a city which floods often, engine may damage due to water entering it. Oil leakage damages car-engine. Engine Protect will take care of it.

Key & Lock Replacement: If our car keys lost, stolen or got damaged due to break-in. This covers the cost of replacement of keys/lock.

Tyre Replacement Cover: Most suited for people driving in bumper to bumper traffic and using stack parking.

![]()

Car Related Needs:

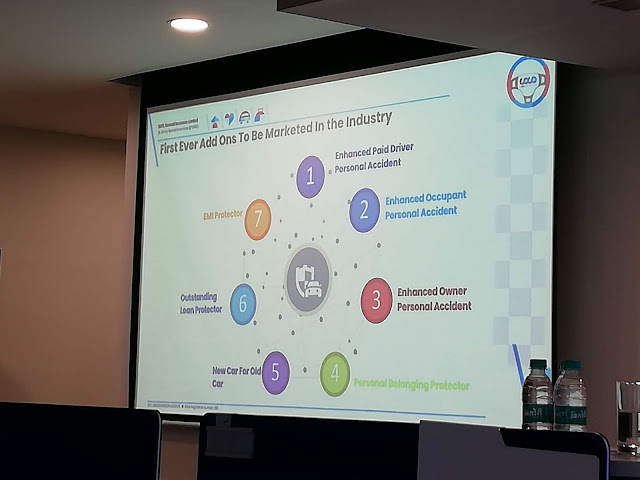

EMI Protector: The tension of an accident, burdened with hospitalisation of more than 7 days, and the worry of having to pay the EMI is horrible. EMI Protector covers up to months of EMI of our vehicle.

Outstanding Loan Protector: In an four-wheeler accident which results in the death or permanent disability of the owner, this cover repays the outstanding loan amount to the financer.

Accidental Hospitalisation add on ensures that the cost of medical expenses do not add, after our vehicle has met with an accident.

Enhanced Owner Personal Accident add on for enhanced coverage in the event of an accident of our four-wheeler leading to death or permanent disability of the owner.

Enhanced Paid Driver Personal Accident add-on is Personal Accident coverage for our paid driver in the event of an accident

Enhanced Occupants Personal Accident coverage, while driving with our loved ones. This add on is for enhanced coverage in the event of an accident of our four-wheeler leading to death or permanent disability of the occupants.

Hospi-Cash provides us a fixed amount, chosen by us when we are hospitalised. This is paid for a period of up to 5 days of hospitalization, post our vehicle-accident.

If our vehicle is under repairs, Daily Conveyance Allowance will be paid for up to 15 days while our vehicle recovers.

Personal Belonging Protector add-on covers for reimbursement of our lost or damaged valuables*.

Emergency Transport & Hotel Stay add-on in our policy takes care of an accident or car break-down. We get reimbursed for immediate transport and lodging expenses if our vehicle cannot be repaired on the spot and is immovable.

Road Side Assistance offers towing service, battery jump start, spare key arrangement, breakdown phone assistance, alternate transport and accommodation if stuck outside our city.

![]()

NCB (No Claim Bonus) Secure: NCB Secure ensures protection of our NCB in case of us having to make one claim during the policy tenure.

NCB Protect - Non Metallic Repair: Depreciation on rubber, nylon, plastic and paint can go up to 50%. If we choose to repair and claim for non-metallic parts instead of replacement, a NCB Protect for Non-Metallic Repair makes sure that the NCB in our policy stays intact.